Abrupt shift from April's confident tone

DETROIT -- After boasting of record profits earlier in the year, Ford Motor Co. last week dropped a profit warning as jarring as concrete blocks hitting the bed of an aluminum pickup.

Executives said the automaker is spending more than anticipated on incentives as U.S. vehicle demand softens, generating less revenue than expected in China and facing at least a $1 billion hit over the next three years from the Brexit vote in Europe.

One Wall Street analyst, Adam Jonas of Morgan Stanley, called the abrupt shift in attitude a possible "watershed" moment for the industry, which largely had brushed aside bubbling concerns about plateauing U.S. sales and rising discounts. Many of the looming threats that Ford CEO Mark Fields laid out are issues other automakers also have to confront, but Ford is the first to acknowledge them so starkly.

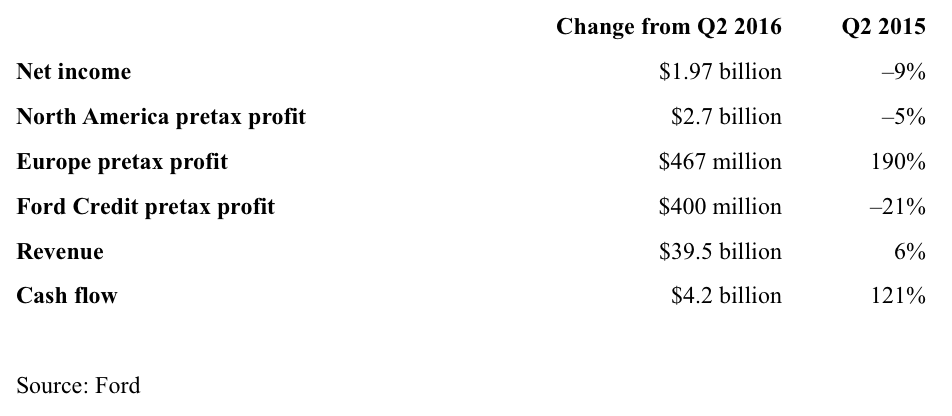

"We remain committed to our 2016 guidance, but we're facing risks to achieving that," Fields said after Ford posted a 9 percent decline in second-quarter net income, which fell short of Wall Street estimates. "We're seeing more pressure throughout the business for the remainder of this year, so as a result, we're calling for the second half of this year, and particularly the third quarter, to be much weaker than normal."

The comments were a significant departure from Ford's confidence in April, when the company posted its highest quarterly pretax profit ever. "Essentially everything has improved," CFO Bob Shanks said April 28. "We're reconfirming all of our guidance to be as good as if not better than the record year that we had in 2015."

Among the biggest surprises since April was the Brexit vote June 23, in which the United Kingdom elected to leave the European Union. Ford said it now sees a weaker U.K. market costing the company $200 million this year and as much as $500 million in each of the following two years.

Ford results

Higher incentives

Ford said it also has been caught off guard by U.S. incentives rising faster than anticipated. Higher North American incentive spending cost Ford $2.2 billion more in the first half than in the same period a year ago.

Much of that was linked to the F-150, which came with little in the way of discounts during the model changeover in early 2015. But Fields said Ford has spent more than intended as automakers fight harder for market share amid slowing sales.

Last week, Ford reduced its full-year U.S. sales outlook for the industry to between 17.4 million and 17.9 million vehicles, including medium and heavy trucks. That would equate to about 17 million to 17.5 million light vehicles, which still would rank among the industry's four best years.

Its previous forecast was 17.5 million to 18.5 million, whereas industry sales last year including medium and heavy trucks were 17.8 million.

So far this year, Ford Motor's light-vehicle sales have outpaced the U.S. market. The automaker sold 1,345,170 vehicles in the first six months, up 4.4 percent. That compares with an overall market increase of 1.4 percent, lifting Ford's share from 15.1 percent last year to 15.6 percent.

U.S. sales of its top-selling vehicle, the hugely profitable F series, were up 11 percent in the first half, including a 29 percent surge in June amid an aggressive Chevrolet ad campaign showing the bed of Ford's aluminum-bodied F-150 pickup being gashed by a toolbox and a load of landscaping blocks.

"The competitive environment has increased as growth has slowed," Fields said. "The bottom line is that we've seen a tougher pricing environment this [second] quarter, and we will face one going forward."

Ford's warning contrasts with more-optimistic guidance from other automakers and suppliers recently. On July 21, General Motors raised its full-year earnings-per-share outlook, and on Wednesday, July 27, Fiat Chrysler upped its projections for revenue and earnings. A day later, supplier Lear Corp. said it would exceed its previous forecast for earnings and free cash flow.

"A lot of obstacles'

Shares of Ford, which had risen 10 percent in July, lost most of that gain Thursday, July 28, after the executives' warnings played into pessimism on Wall Street about the Detroit 3's potential for growth, even after GM's second-quarter net income more than doubled.

"They've just got a lot of obstacles in front of them all at the same time," said David Whiston, an analyst with Morningstar. "It's not like we're on the verge of a recession, but the market wants to see growth, and they're not seeing it. There was already a lot of negative market sentiment around auto stocks, so Ford's news just gives more fuel to the fire."

AutoNation Inc. CEO Mike Jackson criticized Ford during an earnings call on Friday for unreasonable stair-step incentive targets, saying the retailer's Ford stores had been given targets to increase sales in the third quarter by up to 40 percent. "Well, that's just not going to happen," Jackson said. "It's totally unrealistic, and we're not going to chase it. It is disruptive in the marketplace, and it causes irrational behavior, and there's a price tag for that."

Jackson allowed that the situation could improve in three months if Ford's third-quarter targets clear inventory gluts while production is being cut. But the approach is still "not the best way to get there," he said. Jackson added that the industry is at a "crucial point" with three major automakers -- Ford, Nissan and Fiat Chrysler -- operating massive stair-step programs.

Jonas, the Morgan Stanley analyst, said Ford's about-face shows that some of the plans put into place under former CEO Alan Mulally are backfiring as the market shifts away from the small cars that were widely seen as the industry's future only a few years ago.

"Ford's prior leadership had made very large product and engineering bets on fuel efficiency across many areas including segments, weight reduction and engine downsizing," Jonas wrote. "While such initiatives are an important part of the long-term strategic planning of any global auto firm, Ford appeared to pursue such efforts with a greater level of zeal. These efforts proved successful in terms of share and profit in a $100 [per barrel] oil environment but maybe present a pricing and market share challenge in the current environment given changing consumer preferences, however short term."

Fields said Ford has begun "an aggressive companywide attack plan on costs" to improve profits despite growing headwinds. Among the steps Ford will take are manufacturing cuts and improved "go-to-market plans" in the U.S. and China to generate more revenue, though the company would not say whether job cuts are possible. Ford already had scheduled five weeks of downtime in the second half of 2016 at the Michigan Assembly Plant in suburban Detroit, which builds the Focus and C-Max small cars.

"We're going to have to deliver stronger actions on cost," Fields said. "We're going to have to go back and find every dollar of revenue that we can get."

Source: autonews.com